Gold Loan / Pawnbroking Software Features

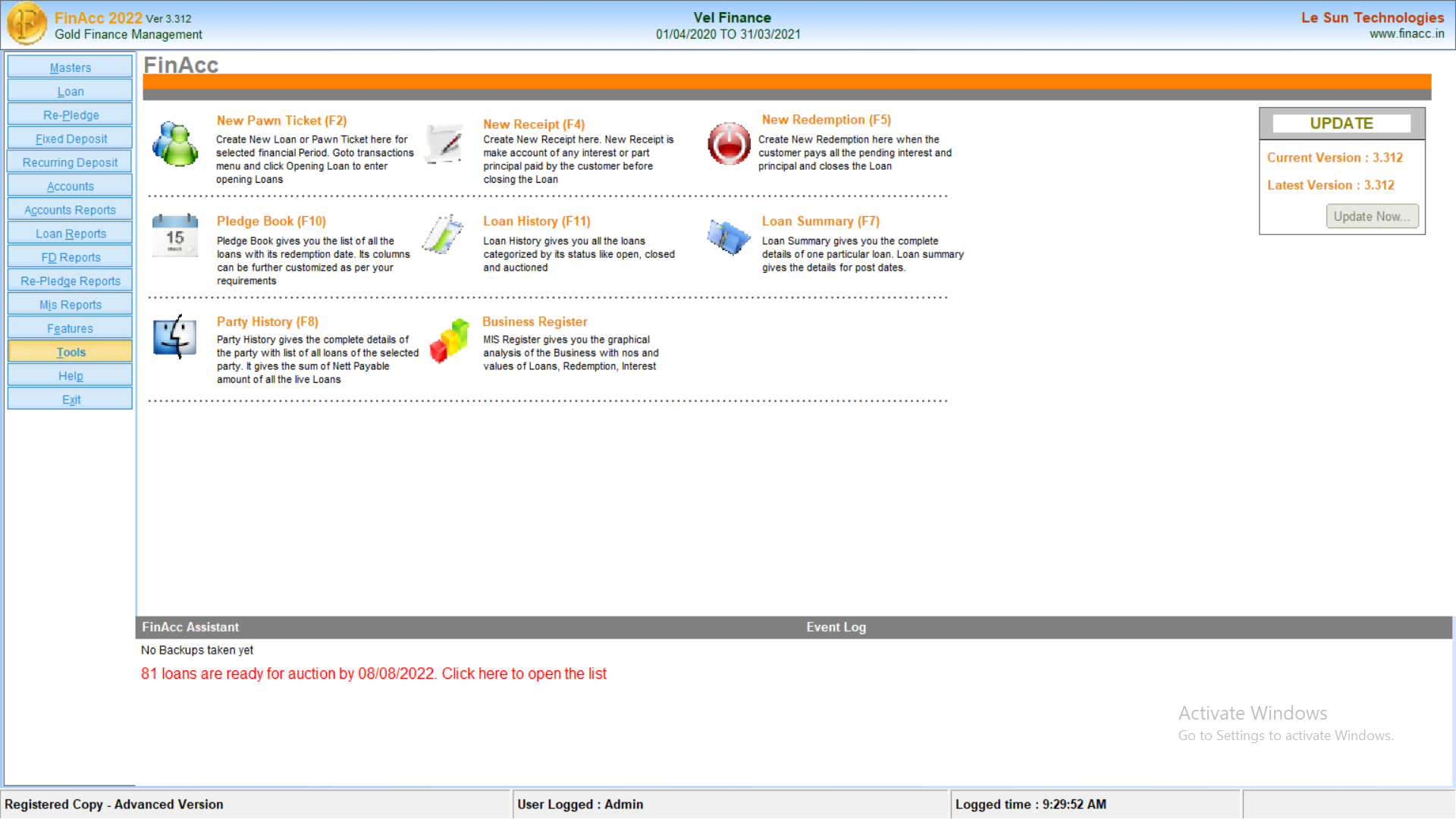

The reason being India's best pawnbroking software is FinAcc is not just recording pawnbroking business transactions in the computer. Above that FinAcc helps in enhancing your business to next level by providing you accurate business reports and listing out bottom line issues in the business and offering with timely information and alerts.

- Blended with Latest technologies like Biometric Integration, Face Recognition, SMS alerts etc

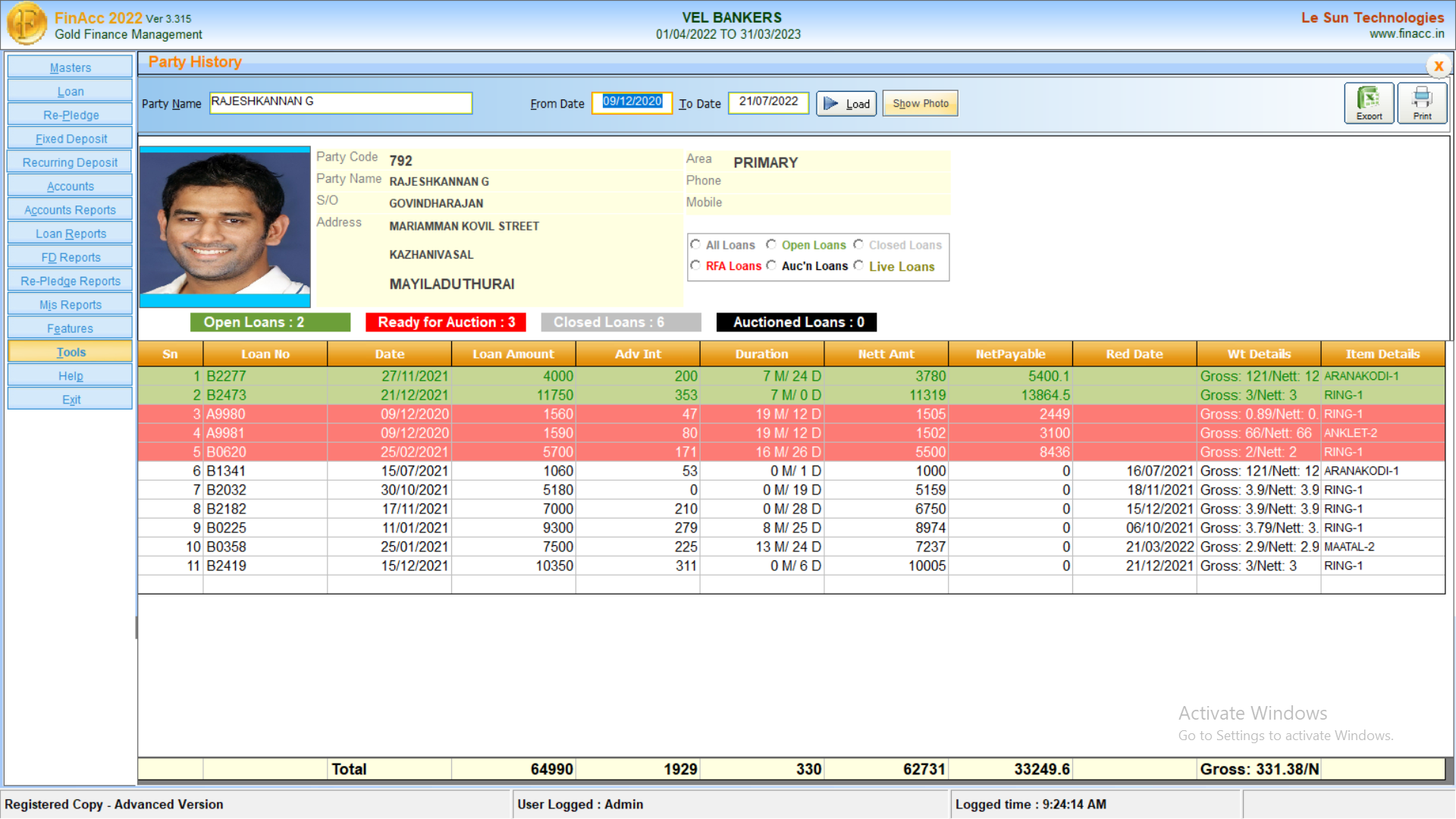

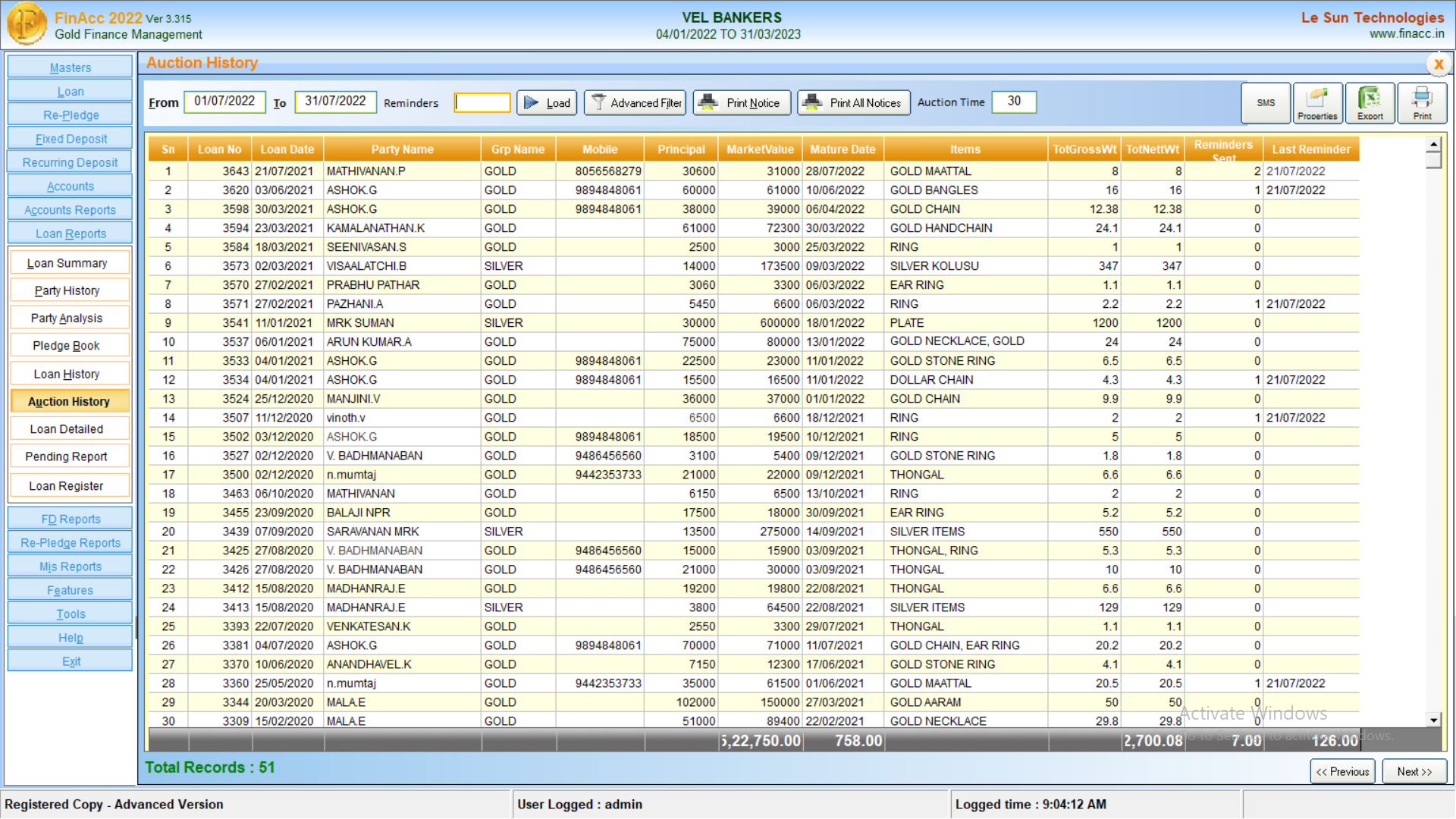

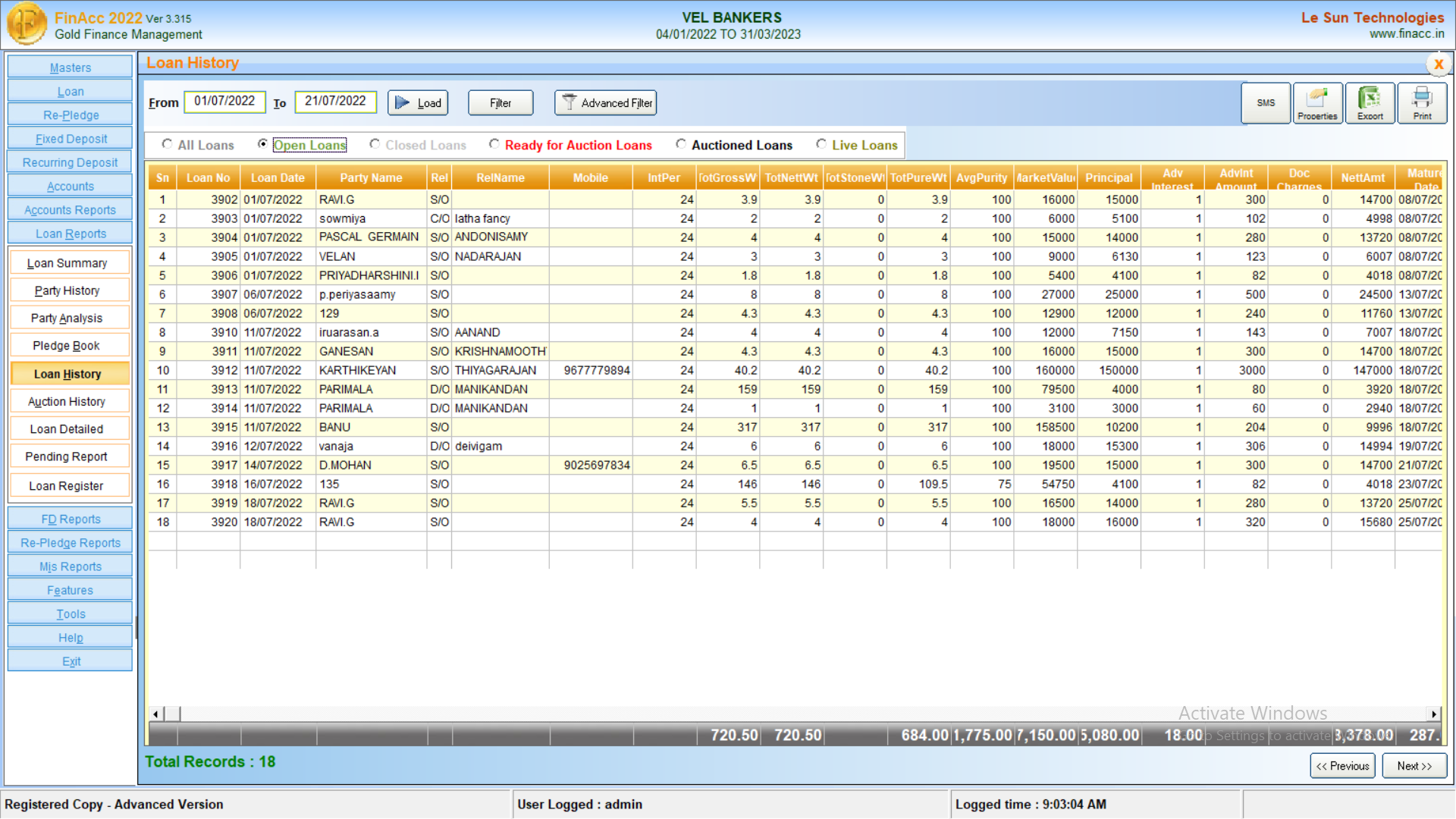

- Finacc’s 1 touch abilities with quick working speed provides you with fast evaluation of clients, loans as well as auction standing loans.

- FinAcc’s sophisticated statistical as well as graphical reports provides you with the total insight into your company

FinAcc was developed in the year 2009 and has sucessfully implemented for more than 1000 clients across India ranging from small pawnbrokers to Corporate Gold Financiers like NBFC.

FinAcc can be installed in any local standalone systems as well as can be hosted in any server or Cloud supporting branchwise operations.

We give much importance to data security and data integrity with cost effective solutions

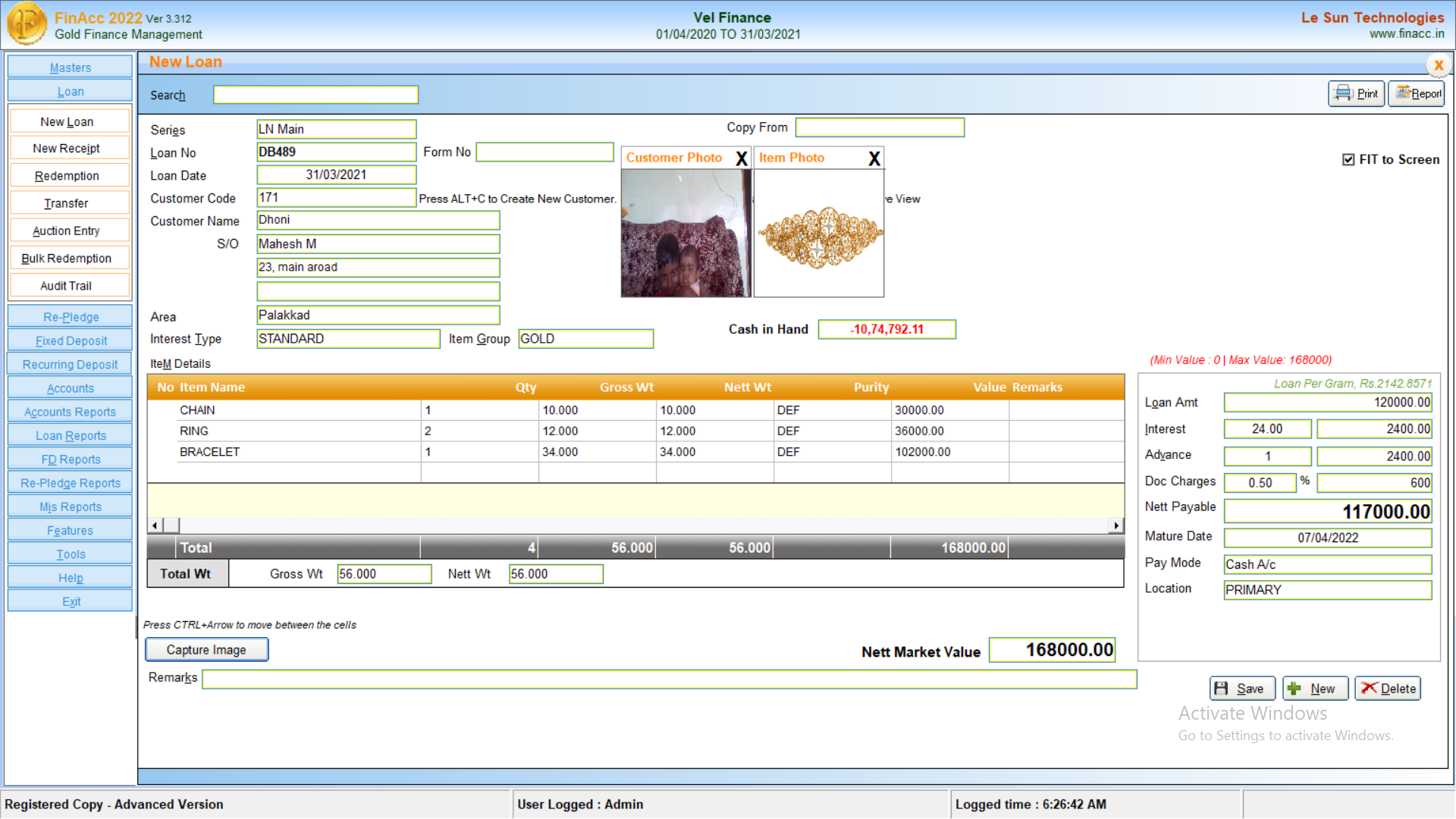

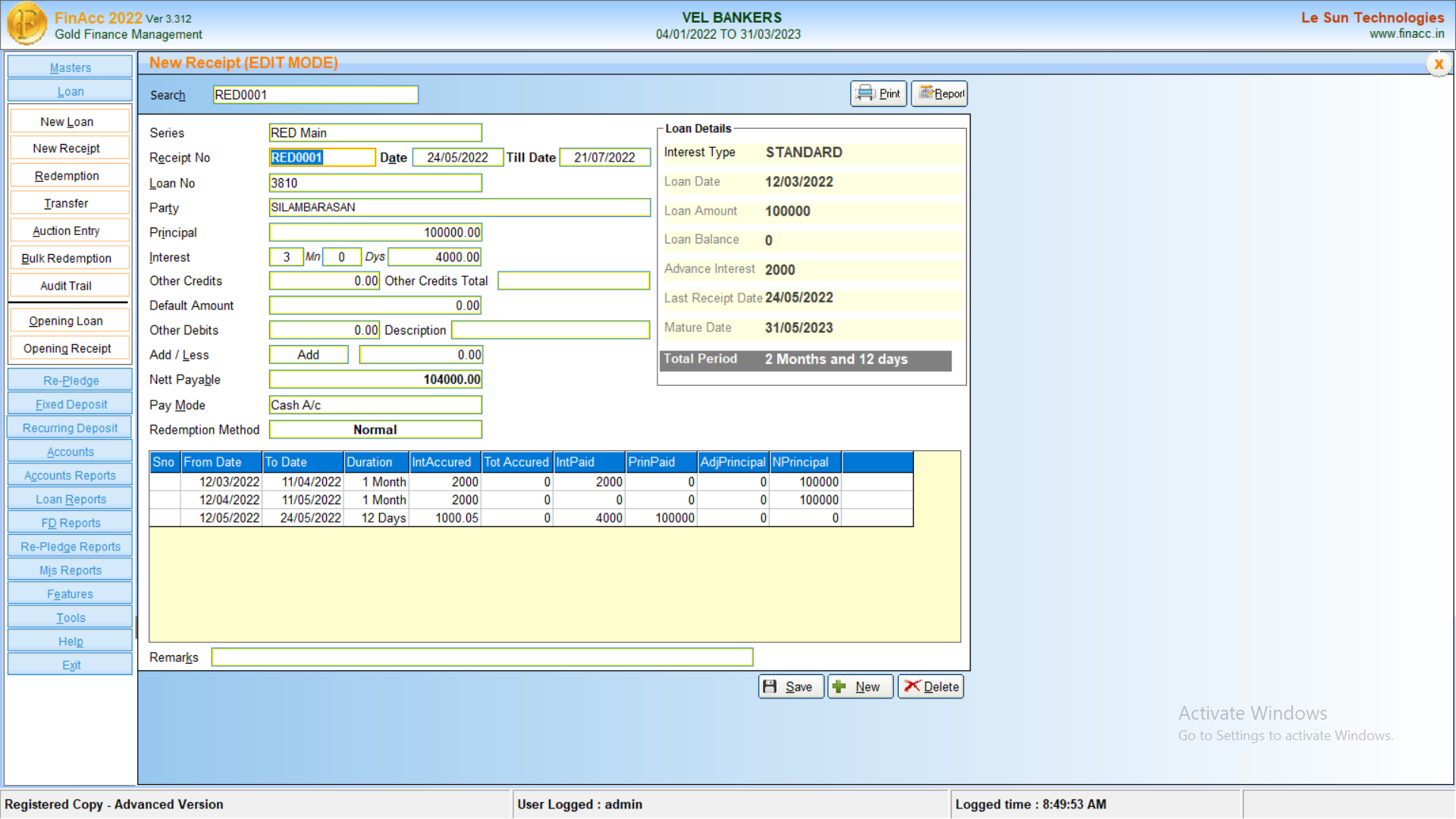

FinAcc as being a trusted thorough solution with regard to Finance company, have right now launched FinAcc- with regard to gold bankers or pawn agents. This pawn store software has developed lots associated with features that completely goes away you guide redundancy function, enabling a person with higher security for the datas. No much more manual publications or registers have to be maintained inside your pawn store business. FinAcc’s sophisticated statistical as well as graphical reports provides you with the total insight into your company and the sharp attention into your company good and the bad. Its ease of use capabilities enables you to interact using the software simpler and comfy.

Finacc’s 1 touch abilities with quick working speed provides you with fast evaluation of clients, loans as well as auction standing loans. FinAcc is actually fully incorporated with monetary accounts as well as avoids the requirement for seperate sales packages. FinAcc’s easy to customize features assisted us to determine our client base in most areas. Some from the major areas our software program implemented effectively are Coimbatore, Chennai, Bangalore, Mysore, Hyderabad, Delhi, Erode, Salem, Madurai, Tirunelveli, kerala.

FinAcc has applied best technology on the market and adapts few not too distant future technologies which keeps pawnbrokers about the edge associated with updated technologies. It keeps you reside even inside your absence within the pawn store. FinAcc’s Mobile and WEB enabled > features keeps all pawnbrokers updated concerning the status of the businesss immediately, no matter where you stand. Its sophisticated security restricts the consumer for any type of mishandling, and such mishandlings tend to be immedietely updated for you with mobile enablity. FinAcc allows pawnbrokers with regard to multiple curiosity maintenance. FinAcc’s Photo capture capability for customers, SMS notification facility as well as Finger printing tracking functions are stick out features on the market. FinAcc has undergone various amounts of testing and therefore are 100% irritate free. FinAcc provides free demo for those pawn brokers without any restrictions within the software. You can travel to www.finacc.in for additional information about the program and downloading it free demonstration. EMail us or give us a call for additional information about the actual features as well as live on the internet demo as well as free usage inside your computer.

Repledge

FinAcc fully automates the repledge transactions in the gold finance business. The Ornaments pledged from customers are again pledged in pawnbrokers bank for the purpose of funds. These transactions can be recorded in the software with Banker's Information, Borrower's Information, Details of Ornaments Part/full, Rate of Interest charged etc., These entries can further be compared with customers loan to analysis the profit and loss of the repledge transactions

Financial Accounts

FinAcc comes with fully integrated financial accounts starting right from voucher to Balance Sheet. It avoids the need for seperate accounting software. The accounting entries related to gold finance transactions are posted automatically. The Interest Income are calculated automatically and posted correspondingly. Further entries like expenses, assets, investments, drawings etc, can be posted via manual voucher provided with the software

SMS / Whatsapp Alerts

All notifications related to pawnbroking transactions are sent via SMS or WhatsApp to Gold Loan Customers. FinAcc provides a seperate module called Notifications module where you can send SMS or WhatsApp alerts to Loan customers. Alerts can be made when a New Pawnticket / Loan is made, when Interest or Principal is received from the customer, when a pledge is closed etc.. Automatic/ Manual Alerts like when the Loan reaches maturity period, monthly interest reminders, OTP generation for Customer Mobile number validation can be sent.

Biometric-Integration / Aadhar Integration

Identifying genuine and legal customers are very challenging and mandatory in Pawnbroking business. Hence FinAcc provides Biometric Module for the clients who are very strict about security. We provide two different modules are single integrated module for proper identification of legal customers Biometric / Aadhar Integrated module. Here clients can use only the biometric module where you can store the finger prints of customers when a loan is dispersed. This finger print can further be retrieved and validated on demand like when the gold loan is closed, fetching completes customers details and loan details etc.,Aadhar Integration is way more advanced and the client just have to type the Aadhar number of the customers, and it retrieves complete details about the customers from the Goverment database, after few validations and security check from the goverment.

Tally Integration

FinAcc comes up with a built-in fully functional Financial Accounting Software avoiding the need for seperate accounting software. All the vouchers related to Pawnbroking transactions are posted automatically. Accounting Vouchers related to Gold Loan, Loan Receipts, Loan Closing/Redemption, Auctioned Loans etc., are posted immedietely when the entries are made. Any other vouchers like expenses, assets, Investments and drawings are to be made manually. However the clients who prefer to maintain their financial accounts in tally can export the vouchers from software to Tally in single click using the Tally Export module in FinAcc, Gold Finance Software

Fixed Depsoits / Recurring Deposits

FinAcc provides seperate module for the deposits received from the party. Deposits like Fixed Deposit and Recurring Deposit comes with Enterprise Module. Fixed deposit module provides options for receiving fixed deposits from customers and paying them the interest on specified frequency like monthly, quarterly or annually. The Interest is calculated automatically based on the specified interest scheme in the software. Recurring deposit module provides option for setting up a Due amount for Recurring deposit and receiving dues monthly. Different RD schemes can be maintained.

Multiple License

Many pawnbrokers main multiple Pawnshop licenses for variety of purposes. FinAcc comes up with a Multiple License module where you can maintain the company transactions identically or combined. This exclusive feature of FinAcc enables the clients to access the gold loan customers created in one license from the other. Consolidated Reports of all licenses of one gold customer can be generated instantly.